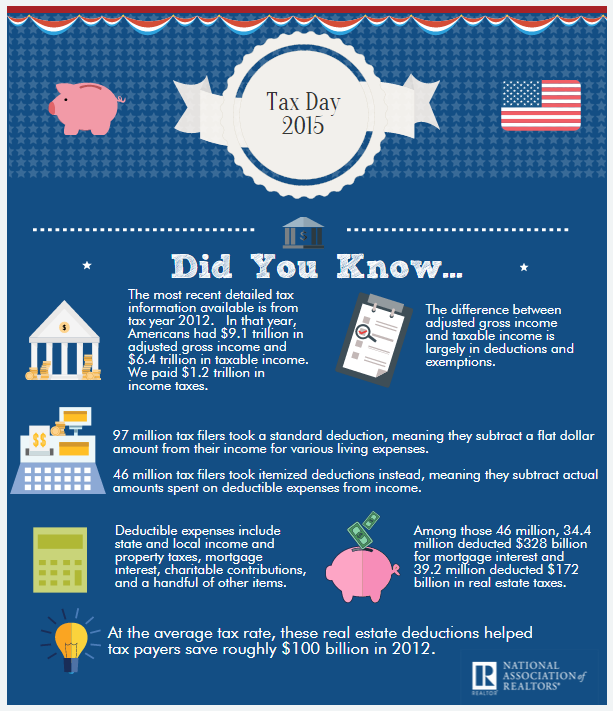

In 2012, home owners saved over $100B in taxes through government incentives. The info graph below shows exactly how this works. It is not too late to plan for 2015 taxes.

Author: admin

For over 12 years, I have been helping clients buy, sell and refinance their homes. Whether it is your home, your business or your investment, we can make it happen!

Buyers Return to the Housing Market

The extract below is from the National Association of Realtors

Default rates jumped in 2006 and between then and 2014 nearly 9.3 million borrowers were foreclosed on, received a deed in lieu of foreclosure, or short sold their home. To date, nearly a million of these former owners have returned to the market and many more of these “return buyers” are already qualified, but waiting. Overlays and credit impairment have held a significant number back and could impact thousands more potential return buyers in the coming years. Roughly a third of formerly distressed owners will ever return to the market.

NAR Research analyzed these former owners taking into account multiple factors:

- The time a buyer must wait to be re-eligible for a financing program with timing like the FHA

- The time necessary to repair the distressed seller’s credit

- Whether the distressed seller’s credit profile, at the time of purchase, was unacceptable by historic, sound underwriting standards

- Whether the return buyer would meet credit overlays in the current stringent environment

- The time needed to build down payment for a purchase

- Whether the buyer has the desire to own again

This analysis revealed that the long time to repair credit scores, time to build down payment, and overlapping post-distress factors limit a former owner’s ability to return.

- Since 2006, 950,000 of these former owners likely already purchased a home again

- However, tight conditions in financial markets limit access to 350,000 of these FHA re-purchase eligible borrowers

- An additional 1.5 million return-buyers will likely purchase over the next five years as they become eligible, but overlays will act as headwinds for 140,000.

- As many 260,000 of current and future program eligible borrowers may not return as their former ownership was facilitated by excessively loose lending in the mid-2000s

At the state level,

- California has been the largest benefactor of return buyers followed by Florida.

- Arizona, Nevada and Georgia also made the list as markets like Phoenix, Las Vegas and Atlanta experienced sharp increases in distress among homeowners during the housing downturn.

- Despite the relatively steady housing markets in Texas and solid price growth, the sheer size of the state put it in the top 10.

Over the coming nine years, the states expected to benefit from the trend will remain the same, though some will juxtapose rankings. Florida will nearly catch California, Illinois and Georgia will rise modestly, while Nevada will ease closer to the bottom of the top 10. Virginia will leave the list and be replaced by North Carolina. The shift in the future trend will also reflect a larger share of prime borrowers that were dragged into distressed events as result of price declines and weak employment, rather than risky lending.

Implications

The large number of return buyers coming to the market will continue to play an important role in the market. This demand is in addition to nascent household formation and the normal baseline demand from trade-up buyers. While overlays will hamper some borrowers, those overlays will likely normalize in the future. Mitigating some risk to Federal programs is a stronger regime of regulation on underwriting and the fact that most return buyers are of prime quality. New credit scoring models that utilize rent and utility payments can help shed light on the risk posed by these return buyers. These innovations will improve the propensity of these borrowers to return and gain access, while reducing their risk to the FHA, VA, GSEs, and private mortgage insurers.

The country and housing market are still healing from the collapse of the foreclosure and distress sale wave. As home prices rise and the economy improves, these trends will abate, but there remains a large reserve of former owners who have the desire and ability to return to the market. New credit models and financing opportunities combined with fundamental changes to the mortgage origination process will help to ensure that soundness of the market as these borrowers return.

Weekly Economic Summary – Feb 29, 2012

There was good news on Friday as Consumer Sentiment rose to 75.3, which is the best level since February of 2011. However, this news was tempered by the rise in oil prices.

On the one hand, high oil prices can be detrimental to the fragile U.S. economy, as consumers have to put more of their discretionary dollars into their gas tanks. High oil prices are also inflationary as the added shipping and material costs apply upward price pressures on producer or wholesale goods. The upward prices either have to be absorbed by the producer, thus hurting profits and the ability to expand or hire; or the added costs get passed onto the consumer.

The silver lining is that the dampening effect on economic growth produces a sluggish economic environment in which bonds (including mortgage bonds, to which home loan rates are tied) thrive. This is an important topic to continue watching in the weeks and months ahead.

Last week, investors and central bankers came to an agreement to provide Greece with 130 billion Euros ($172 Billion) in financial aid. This will help the country fund itself through March and into the future, as long as it institutes economic reform, austerity measures and meets deficit targets.

Between some of the overseas uncertainty being lifted, a lower unemployment rate, and better than expected economic reports, home loan rates have struggled to improve beyond levels seen over the past two weeks.

Weekly Economic Summary – Feb 22, 2012

Housing Starts came in better than expected, while both the New York Empire State Index and the Philadelphia Fed Index reported positive manufacturing news. The Weekly Initial Jobless Claims fell by 13,000 in the latest week to 348,000 — the lowest level since March 2008. Meanwhile, Retail Sales rose in January by 0.4%, the largest gain since October.

Remember, strong economic news often causes money to flow out of bonds and into stocks, as investors hope to take advantage of gains. That’s partly what caused bonds (including mortgage bonds, to which home loan rates are tied) to worsen late last week.

Also weighing on bonds and home loan rates was the news that inflation is heating up. Despite the Fed’s claim that inflation is moderating, the Core Consumer Price Index (CPI), which excludes high volatility items such as food and energy, rose to its highest levels since October 2008. The Core Producer Price Index (PPI), which is an indicator for wholesale inflation, rose double the expectations of 0.2%, coming in at 0.4%.

Last week’s uncertainty in Greece was another key factor, as it also impacted bonds and home loan rates. Eurozone finance ministers completed a deal early this week that will provide Greece with the funding it needs to avoid default next month. U.S. bonds and home loan rates have benefitted from all the uncertainty in Greece, as investors have seen our bond market as a safe haven for their money. While Greece’s uncertainty seems to have resolved, time will tell whether this safe haven trading will continue in the face of other European countries’ economic uncertainty.

Tax Credit Extension for First-time Home Buyers

Here’s a primer on who might be able to get the expanded credit, and what it might do for the housing market:

Who gets the credit, and how much can they claim? First-time home buyers are eligible for up to $8,000 on the tax credit, which is the same as the current credit. The Senate version of the bill creates a new credit of up to $6,500 for homeowners who have lived in their homes for five years. That provision would start on Dec. 1.

How long will it last? The tax credits would expire on April 30, 2010, but home buyers under contract by April 30 would be able to qualify as long as they complete the sale within 60 days. Keep in mind, this would be the third iteration of a home buyer tax credit that has been in place since mid-2008. Sen. Johnny Isakson, the Georgia Republican who has been a staunch advocate of the credit, promised that this would be the “last extension” of the credit, according to Dow Jones Newswires’ Corey Boles. “Tax credits like this only work by creating the sense of urgency to take advantage of it,” Sen. Isakson said.

Will the tax credit do anything for the high-end of the market? Probably not. The tax credit phases out for home buyers with incomes above $125,000 for single filers and $225,000 for married couples. Also, homes that cost more than $800,000 aren’t eligible for the credit. Overall, the tax credit is likely to generate only a modest further increase in home sales, says Tom Lawler, an independent economist in Leesburg, Va. For many well-paid people, he says, it won’t make a big difference: “A household earning around $150,000 is likely to buy a home of $500,000 plus, so a $6,500 credit won’t be much of a factor in pushing such households off the fence.”

What other limits does the credit have? People under the age of 18 are not eligible. Last week’s congressional hearings spotlighted concerns about misuse of the credit, including some 500 tax filers under age 18 who had claimed the credit.

So will the expanded tax credit help sales? That’s a point of debate among housing analysts and economists. Alec Phillips, economist at Goldman Sachs, notes that expanding the credit to people who already own homes doesn’t necessarily make a big dent in the supply of housing on the market. “If these ‘step-up’ buyers already own a home and sell it to finance the new one, that hasn’t reduced the amount of inventory for sale,” he says.

But Mark Zandi, chief economist at Moody’s Economy.com, thinks the extension is a big deal. Based on a preliminary analysis, he said it should mean at least 500,000 in additional sales, atop the 400,000 he estimates already have been generated by the tax credits (twice the Goldman estimate). “The tax credit is not a very efficient tax cut, but not extending it would do significant damage to the still fragile housing market,” Mr. Zandi said.

If you have any further inquiries on this matter, please don’t hesitate to contact us.

Mortgage Rates in an Uptrend

Mortgage rates continued to trend higher this week, according to Freddie Mac, which reported this week that the average rate on a 30-year fixed-rate loan was 5.03%, up from 5% a week earlier and from an all-time low of 4.87% in the week ending Oct 8th.

Rates on shorter-term fixed-rate mortgages and adjustable-rate loans also rose. For 15-year fixed-rate loans, often used by borrowers seeking to pay off their mortgages faster, the rate this week averaged 4.46% with 0.6% of the balance paid in lender fees and points, up from 4.43% with similar upfront costs last week. For the full year, 30-year fixed rates have averaged just below 5% thanks to intervention by the government, triggering a refinancing boom. Seven of every 10 mortgages this year have been refinancings.

This means that you still have a great opportunity to refinance your current home or even look for depressed properties which could present a great opportunity to buy something that will definitely be worth a lot more in a few years.

As always, I am available to help you look for a new home or to refinance your current home. To check out my listings, click here or you can Contact me.